In August 2022, the Biden-Harris Administration announced a student debt relief plan that includes one-time student loan debt relief targeted to low and middle income families. Applications for this debt relief program opened in early October 2022.

The University Office of Scholarships and Financial Aid at 5XÉçÇř provided an information session to assist students, alumni and university community members with this student loan debt relief program. Brenda Dillon, assistant director of Student Financial Aid, provided attendees with the latest information regarding the program.

Here’s some of the information highlighted in this meeting, in case you missed it:

Recent Updates

- Students have until December 31, 2023, to apply for debt relief or loan forgiveness.

- Students who have been automatically approved for one-time student relief should have received an email indicating that they do not have to take any action to obtain debt relief.

- The payment pause for student loans is ending on December 31, 2022.

- Any borrowers not interested in one-time debt relief have until November 14, 2022, to opt-out.

- The Department of Education is on a temporary hold for debt relief/loan forgiveness due to challenges in courts in several states. However, they are still encouraging anyone to apply for forgiveness, despite this hold.

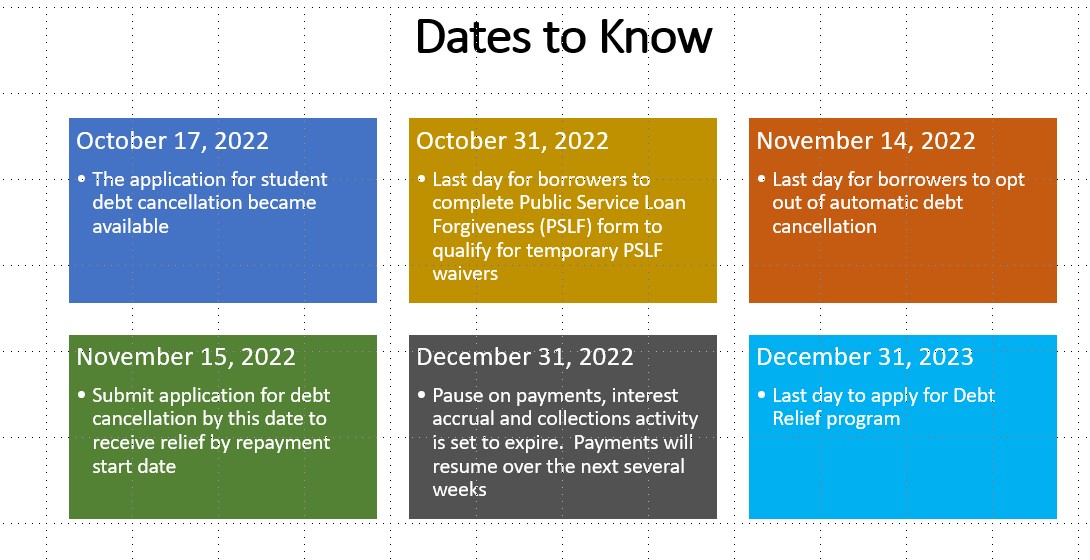

Important Dates to Remember

Who is Eligible for Forgiveness

There are two groups who are eligible for forgiveness. The first group includes approximately eight million people who filed for FAFSA in 2020 or 2021 and do not need to apply. Anyone from this group would have received an email from the U.S. Department of Education that they were automatically eligible. Anyone who is in this group and wants to opt-out of debt relief needs to contact their servicer by November 14, 2022.

The second group includes all other eligible borrowers who must submit an application at studentaid.gov.

All applicants must meet income thresholds to be considered eligible.

Single tax filers making less than and have a household income of $125,000 in tax year 2020 or 2021.

Those who file jointly as a married couple or head of household and have a household income of $250,000 or less in the tax year 2020 or 2021

If you meet the income requirements, the amount of debt relief is then dependent on if the borrower ever received a Pell grant. Pell Grant recipients are eligible for up to $20,000 in debt relief. Borrowers who did not receive a Pell Grant, are eligible for up to $10,000 in debt relief.

“You know, there are lots of various scenarios out there,” Dillon said. “When in doubt, if you're interested, definitely go ahead and apply for debt relief.”

Application Requirements

Students can apply for one-time student debt relief here. The only information required from applicants is their social security number, date of birth, phone number, email address and name. If a student has received an email regarding their debt relief, they do not need to apply for forgiveness.

When to Expect Relief

Applicants can expect to receive debt relief in four to six weeks after applying. There may be a longer waiting period due to the temporary hold in the Department of Education.

Beware of Scams

Dillion warned attendees of scams surrounding debt relief forgiveness. She encouraged attendees to sign up to receive text messages from Federal Student Aid because this is a reliable way to receive updates concerning these sensitive topics.

“One thing that the Department of Education has shared with us is that they will not be making phone calls. We've already heard from the Department of Education as well as through the National Association of Student Financial Aid Administrators that there have been scams,” Dillon said. “A lot of places are calling and saying that they are making phone calls about your account. Just hang up and go to the student aid website to check your account status or see any notifications.”

Visit the Kent State Office of Scholarships and Financial Aid website www.kent.edu/financialaid/loan-forgiveness.

Learn more about Federal Student Aid .

See other available resources shared in this session: